we hosted an amazing AMA with MDEX on the 8th of September

And here we will put some of the best questions:

Q1. Can you introduce yourself to our community?

Hi, I am Kiko, the CMO of Mdex. I have been in the crypto market for 3 years. I have extensive experience in the Crypto industry particularly in DeFi. MDEX is an exciting and innovative project on the market that has made significant strides over a short period of time compared to its peers. After getting into the crypto industry, I never looked back and my goal is to explore as much about this field as I can.

Q2. Can you briefly tell us what is MDEX ?

The concept of DeFi has already launched in the market in 2018. But at that time, DeFi did not arouse huge attention from people and many users did not understand the actual benefits DeFi can bring. Until the popularity of Uniswap rising fast in a short time in 2020, a large number of users began to pay attention to DEX, and then have deep impression on DeFi. However, the skyrocketing price of Ethereum has caused congestion in transactions and high transaction fees. Thus, it is difficult for ordinary investors to bear the transfer fees of tens of hundreds of dollars for a single transfer, which gives other public chain opportunities. With the large-scale promotion of BSC public chain and HECO public chain, MDEX was born under such an opportunity with the high-performance advantages of HECO and BSC.

MDEX.COM is a decentralized cross-chain transaction protocol that supports BSC and HECO, long ranking No.1 on the DEX rankings of CoinMarketCap and CoinGecko. It combines the advantages of low transaction fees on the Huobi ECO Chain and prosperity of Binance ecosystem, aiming at creating a high-performance composite DEX ecosystem, providing maximized rewards for participants with the “dual mining mechanism” of liquidity mining and transaction mining. It also manages to realize a closed and self-driven loop for value capture through using its transaction fees to repurchase and burn MDX.

The original intention and vision of MDEX is to start from trading, commit itself to building a DeFi platform integrating DEX, IMO, and DAO. In this way, it provides one-stop liquidity services for more high-quality assets, and offers users with safe, reliable and cost-effective transaction experience with diverse and high-quality assets.

Q3. Let’s now talk about the milestones you have achieved so far and about your upcoming plans?

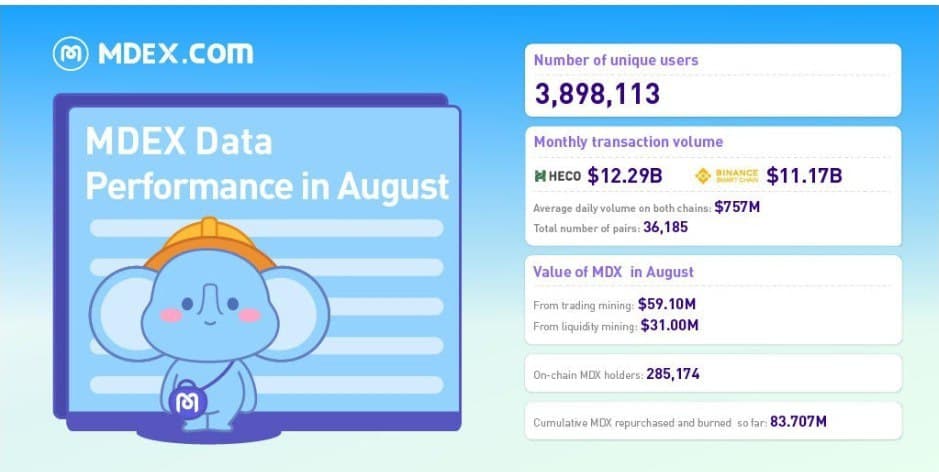

MDEX officially launched transaction mining and liquidity mining on January 19, 2021, with safe and smooth operation for more than half a year. During this period, MDEX successfully implemented Dual-Chain Deployment and launched on the Huobi Ecological Chain (Heco) and the Binance Smart Chain (BSC). As of August 31, 2021, MDEX transaction mining subsidies and liquidity mining rewards have produced a total of 646 million MDX, worth over $900 million, and the MDEX boardroom has completed a total of about $480 million in rewards; MDEX daily transaction volume ranks No.1 in CoinMarketCap and CoinGecko of the global DEX rankings, and still keep topping the list; the cumulative transaction volume of last six-month has exceeded $400 billion. MDEX Dual-Chain Deployment (Heco&BSC) TVL exceeds US$2.5 billion.

On February 6, 2021, MDEX launched the Boardroom Repurchase and Burn Pool, the world’s first smart contract that automatically executes the repurchases and burn mechanism. As of August 31, 2021, MDEX dual-chain (Heco&BSC) had repurchased and burned totaled 83 million MDX, with an average daily repurchase and burn volume of 370,000 MDX and a total repurchase amount of more than $186 million.

In order to give MDX more ecological application scenarios, MDEX has launched a number of product functions:

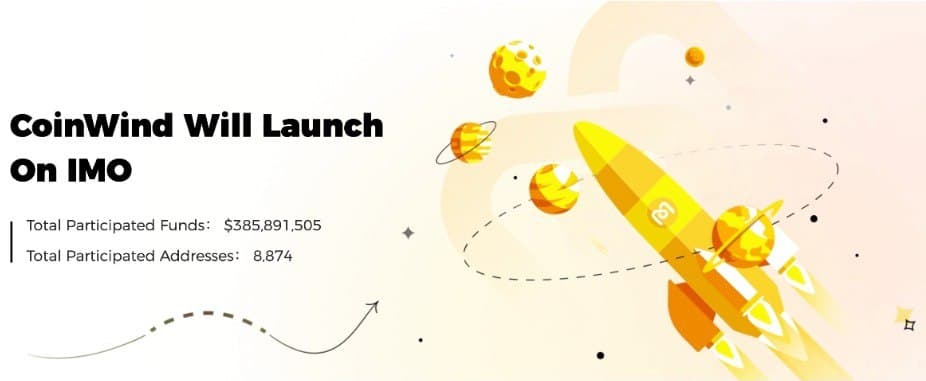

1.In the first phase, the number of participants of IMO (Initial Mdex Offering) exceeded 8,874, with a total transaction amount of $387 million;

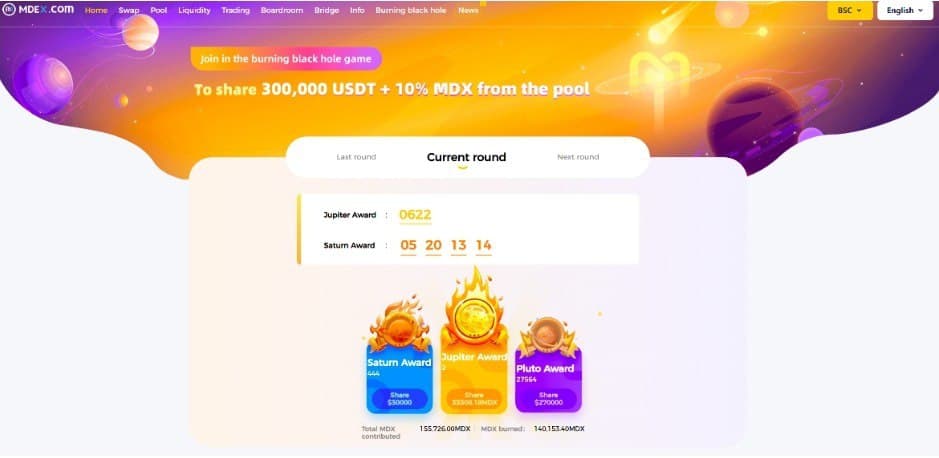

2.Up to now, 13 “Burning Black Hole” campaigns have been launched, with more than 1.91 million MDX being burned.

Global expansion will be a focus of MDEX’s operations in the near future. It will expand MDEX’s brand influence in the entire DEX industry, so that more and more users can understand the use of MDEX transactions, namely mining, liquidity mining, and subsequent ecological scenarios.

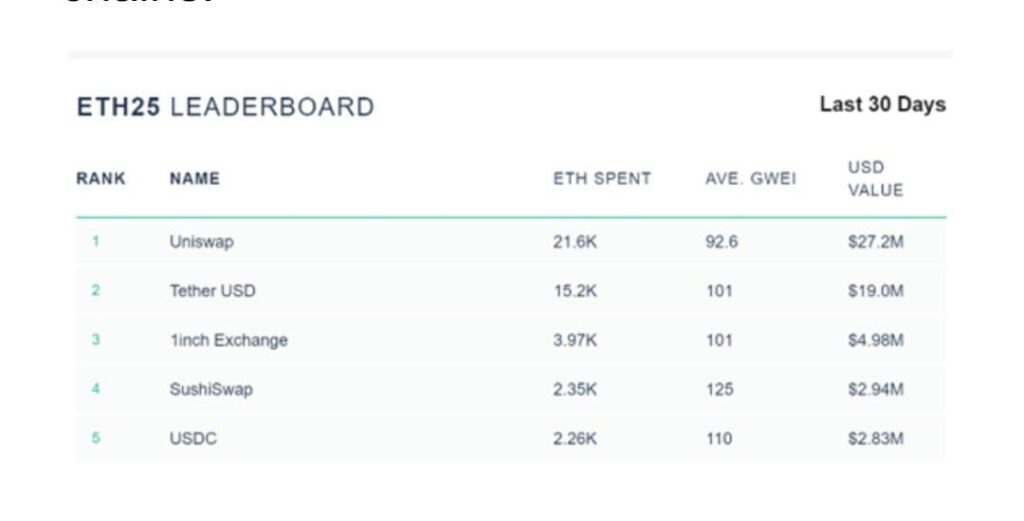

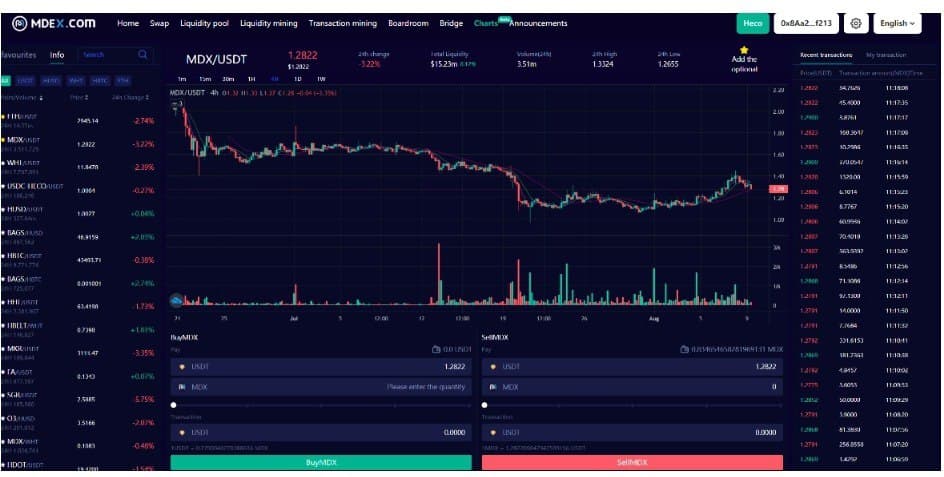

This is the data performance of MDEX in August, let’s take a look!

Q4. MDEX launched the Boardroom Lock-up function in July. What is the data performance after the launch?

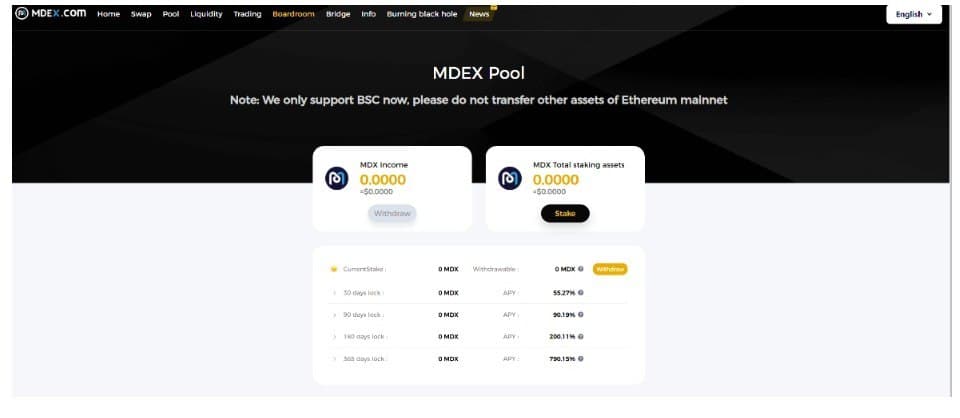

MDEX launched the Boardroom Lock-up function on July 17, marking another step towards DAO. Up to now, the MDEX’s double-chain lock-in market capitalization has exceeded $600 million, MDX lock-in rate of 89.62%, MDX with more than 30-day lock-in volume accounting for 62.93% of the total circulation, and only 6.4 % of actual circulation of MDX.

MDEX has been maintaining outstanding performance because of its premium products. On the one hand, it creates differentiated liquidity mining and transaction mining functional value for its users. On the other hand, the Boardroom staking lock-in gives users more rights and interests, allowing MDX holders to enjoy long-term ecological benefits and governance rights.

For the 365-day lockup of MDEX boardroom, the APY is over 500%, and users can choose to lock up their assets for 30 days, 90 days, 180 days or as a demand deposit. Although the lock-up APY might fluctuate, it is still ranking on top among its peerproducts on the market.

Q5. We noticed that MDEX has just released a new product – Invitation Mechanism. We would like to know why MDEX released this invitation product during this time period?

The Invitation Mechanism is not an innovative product of MDEX. At present, several leading CEXs in the industry have this mechanism for a long time, and some other DEX platforms have also launched the functions of invitation with good feedback. People who invite friends to do transactions on MDEX not only enjoy platform commission but also save service fees for their friends. This is in line with the original intention of providing users with a cost-effective transaction experience and giving users benefits at the beginning of MDEX’s establishment. This Invitation Mechanism achieves a lower cost of centralized transactions and meets users’ demands.

After the functions of invitation are launched, the MDEX team may hold similar activities such as team transaction competitions in the follow-up operation plan. This can effectively promote the activity of the platform and allow more people to learn about MDEX. The more the transactions on MDEX, the more transaction fees, and the more the number of MDX repurchased and burned, creating a benign closed loop.

And here we will put best questions from our members and MDEX fans:

Q1) To date I think more Ethereum or BSC based projects are more successful and profitable than others but why did you choose HECO, how would you respond? So what innovations and advantages do you offer and is MDEX really the best choice for users and investors?

The current development of MDEX on HECO is very good, mainly due to the low transaction slippage of MDEX itself, transaction mining fee subsidy, basically 0 gas fee, rich asset types and other advantages, as well as the support of Heco. But if we want to make MDEX greater, we need to connect different applications and scenarios across chains, different platforms and different ecosystems. Building a multi-chain, high-performance composite ecological DEX has always been the direction of our efforts, so the current deployment of BSC is imperative. Next step, there will be the layout of public chains such as ETH, OKEXChain, and DOT. Once this cross-chain step starts, it will not stop, until different users from different ecosystems are satisfied.

Q2) What is the DAO model that MDEX has proposed? How will you provide MDEX holders with long-term ecological benefits and governance rights that make them part of your project and feel committed to its growth? What are the requirements for membership in your DAO?

The current development of MDEX on HECO is very good, mainly due to the low transaction slippage of MDEX itself, transaction mining fee subsidy, basically 0 gas fee, rich asset types and other advantages, as well as the support of Heco. But if we want to make MDEX greater, we need to connect different applications and scenarios across chains, different platforms and different ecosystems. Building a multi-chain, high-performance composite ecological DEX has always been the direction of our efforts, so the current deployment of BSC is imperative. Next step, there will be the layout of public chains such as ETH, OKEXChain, and DOT. Once this cross-chain step starts, it will not stop, until different users from different ecosystems are satisfied.

MDEX’s upcoming DAO governance rules are as follows:

- All holders of Boardroom Lock-up MDX will receive the official DAO governance voucher tokens issued uniformly. The governance voucher can be used in the following scenarios :

1)Voting for favored Directors and community proposals

2)Participate in the IMO;

3)Running for Director.

2.With the governance voucher, you will get the right of DAO governance

1) Stake a certain amount of governance vouchers, so as to participate in the Director Elections. The users can vote for their favored directors.

From the beginning of each natural month to the end of the month, 30 days, and according to the order of an average number of votes, the 9 address holders with the highest number of votes become the 9 directors.

After all directors are successfully elected, the election stays valid for one natural month.

2) All users who hold governance vouchers can initiate community proposals, and further submit them when staking a certain amount of governance vouchers.

3) Directors can choose the community proposals they support. Proposals supported by no less than 5 directors can enter the community referendum.

4) All users vote on the proposals. During the voting period, the proposal with the most votes will be approved and finally executed by the MDEX team.

Q3) There are many very successful blockchain projects with the same ideas as #MDEX, so can you tell us the difference between #MDEX & those projects? Do you feel confident that #MDEX will have some outstanding features compared to those projects to attract users?

The current processing speed of the Ethereum network is about 15 transactions per second. A Swap operation on Uniswap takes about 20 seconds on the condition that the internet works smoothly. Once the Ethereum network is congested, users generally need to wait for more than 1 minute, and may even encounter a transaction failure.

MDEX is backed by the Huobi ecological chain Heco. Taking advantage of Heco’s public chain performance, MDEX’s Swap operation time takes about 3 seconds, so users have almost no sense of delay. The trading experience can almost catch up with centralized exchanges.

Transaction fees are critical to user experience. The levels of fees charged directly determine users’ revenue from each transaction.

According to data from EthGASStation, Uniswap users have spent a total of 31,500 ETH on GAS in the past 30 days. A transaction on Uniswap may cost the users 3 to 5 US dollars. The speed of the transaction is undesirable. If you want to complete a Uniswap transaction faster, the GAS fee may be as high as 20 to 30 US dollars, which are rather expensive for ordinary DeFi users.So in order to solve the problem on ethereum, we start to launch on HECO, BSC and other chains.

Q4) As the core medium of the MDEX exchange token, MDX not only represents the rights of holders, but also has practical “application” value. Can you please explain to us what are the “MDX Application Scenarios”? What do you have for the ecosystem? And are there any use cases?

MDX application scenarios

As the core medium of exchange token of MDEX, MDX not only represents the rights of the holders, but also has its practical application value. MDX can be used in the following scenarios.

1 Governance tokens

MDX is a community-led decentralized project that can be used for community governance of MDEX to make decisions on major issues in the community. Such as voting on transaction fee ratios, review of other important rules, and the decision to achieve deflation in the face of periodic repurchase and destruction of tokens. The list is as follows:

MDX

1.1 Voting

The comprehensive evaluation is made according to the transaction volume and total value locked of the project, and the MDX users vote for the decision.

1.2 Repurchase and destruction

MDX will charge 0.3% of the transaction fee, and 66% of the total fee income will be used to repurchase and burn MDX and buy HT to airdrop to users who mortgage MDX. Among them, 40% of the above allocation ratio is used to repurchase and destroy MDX, and the remaining 60% is used to purchase HT for airdrops to MDX pledgers, and the chain is transparent.

2 Standard fundraising tokens

MDX is also a standard fundraising token used by HT-IMO, a de-centralization fundraising protocol based on MDEX platform. It’s similar to use ETH to do ICOs on Ethereum platform and will have greater value as IMO is widely used.

Q5) As a DEX, providing users with the best transaction experience is always the core of the exchange. What recent measures does MDEX have to improve the transaction experience for users?

Even though MDEX has already attracted a lot of users in the DEX industry, MDEX will keep to explore the future direction of the DEX market, and continue to provide users with a better experience. MDEX launched the Market Information Function in July. Therefore, the users can quickly understand the updated information in the market, easily do transactions and gain more transaction opportunities. This function is a new product in the DEX industry and will continue to improve and iterate in the future.

The aforementioned Invitation Rebate Mechanism is also a measure taken by MDEX to benefit users, aiming to better bring more rights and interests to users. MDEX will plan to launch the Order Book Function soon. By then, it will support the users to use limit orders, market prices and other functions for transactions. All pending orders are stored in the order book of blockchain, and the orders in the order book will be matched, transacted and settled accounts according to the conditions of the order. This is a highly decentralized model. After launching this function, it will greatly reduce the gap in transaction experience with centralized exchanges.

Q6) What are your security measures adopted from hacking and bugs in smart contract ? Have you conducted any audit to make your smart contract safe?•Where can I buy it?

•also all the links to all your social media platforms if possible?

Mdex smart contract is safe and well audited by a reputable auditing firms such as codeSafe, certik. Users funds are secured and users don’t store their funds on our platform, they have control of their funds. You can check our audit report on our website www.mdex.com

Q7) What are your thoughts about NFTs? will you integrate NFT with your platform?

Yes, NFT business will be carried out about Mdex mascot in the future. For more information, please pay attention to our group notice which will keep you informed of the whole progress.

Q8) What is the $MDEX utility in the ecosystem? Where it will be used and why would the demand for $MDEX increase? Also, Where can I buy $MDEX tokens right now and What are the advantages we get when holding your tokens?

Mdx token is a utility token which is the core medium of exchange token of MDEX, MDX not only represents the rights of the holders, but also has its practical application value. MDX can be used as Governance tokens.

MDX is a community-led decentralized project that can be used for community governance of MDEX to make decisions on major issues in the community. Such as voting on transaction fee ratios, review of other important rules, and the decision to achieve deflation in the face of periodic repurchase and burn of tokens.

Also MDX is a standard fundraising token used by HT-IMO, a de-centralization fundraising protocol based on MDEX platform. It’s similar to use ETH to do ICOs on Ethereum platform and will have greater value as IMO is widely used. Mdx holders will be able to participate in our IMO.

Q9) Do you have any Coin Burn / BuyBack systems or any Token Burn plans to increase the value of Token & attract Investors to invest?

We do allocate some Mdex of our daily platform income into the repurchasing and burning pool, the allocated funds are used for repurchacing and burning the MDX. Whenever the market price is lower than the 3 days average price, our smart contract gets triggered and the repurchasing and burning will be automatically executed. If the actions are not triggered, the tokens will continue to accumulate into the repurchasing and burning pool.

And this was the end of our AMA with Mdex.

If you have any other questions you can ask here:

ℹ️ℹ️ Useful links ℹ️ℹ️

Website :- www.mdex.com

Medium :- https://medium.com/@MdexOfficial

Twitter :- https://twitter.com/Mdexswap

Github :- https://github.com/mdexSwap

Youtube :- https://youtube.com/channel/UCG6mfqZ0bqFpPdOZNoSW9fg

Discord :- https://discord.com/invite/3TYDPktjqC