We hosted an amazing AMA with Sirius Finance on the 27 of April.

And here we will put some of the best questions:

Q1. Can you please introduce yourself as well as Sirius Finance?

Hello everyone, I am Leaf, the chief operating officer of Sirius Finance Team.

Now onto our project, Sirius finance is a cross-chain stablecoin AMM, that attracts and locks tremendous value through stablecoins and provides low-slippage trading. We aim to serve as a low-slippage stablecoin swap protocol that connects Polkadot, EVM-compatible chains and other major layer1 blockchains.

Sirius Finance has 2 main tokens: SRS and veSRS which is generated by locking SRS.

Its Dapp was launched about 2 weeks ago and our governance feature went online 2 days ago. So we are at the very early stage of development, feel free to call yourself an early bird if you know us by this AMA.

Q2. What are the advantages of Your project?

To put it in this way, within 2 hours of launch, we achieved 18 million TVL ATH while there is another project that took 2 weeks to have 10 million of TVL, both of us are stablecoin AMM and on Astar network.

Besides, as far as we know, compared with other stablecoin AMMs, even Curve, we now have a very competitive low slippage.

Since impermanent loss is a major problem in all AMMs because of the volatile nature of most crypto assets. Most people don’t even realize that at some point, their loss becomes permanent but because Sirius is focused solely on stablecoins, liquidity providers won’t encounter such risks and it makes it very attractive, proof of that is why Curve has the highest TVL in the whole DeFi space.

Lastly, deep liquidity is very essential for every chain to thrive and having a stable one makes it extra better.

We believe that It is a reasonable outcome as well as the best proof of everything we’ve been building: user-friendly interface, attractive APY as the launching strategy of course, product design, strong community base, close connection with Astar ecosystem, etc.

Can’t say we excel in a specific area that makes us succeed, we just try our best working on every part that we could think of.

Q3. please tell us about the goal you want to achieve in this year?

As it was mentioned, we aim to serve as a low-slippage stablecoin swap protocol that connects Polkadot, EVM-compatible chains and other major layer1 blockchains.

Following are the key elements from our roadmap for the rest of this year:

We already accomplished:

DApp production launch

$SRS and veSRS token launch (Non-transferrable)

Add governance using snapshot for SIPs (Sirius Improvement Proposals)

DApp mobile version launch

Collaborate with protocols on Astar Network(AstridDAO, Orcus Finance, Alnair, Libra, Starbank and many more)

Q2 In process:

Private A & B fundraising

Build the Sirius ecosystem with partners on the Astar chain

Partnership rewarding program

Multisig for smart contracts

Rewarding dashboard launch (one place to see all rewards)

IDO

Q3

Launch additional pools

Protocols optimization

LP Pools creation

Website V2 launch

DApp V2 launch to provide a smoother user experience

DAO launch

Permissionless pool creation

Unlock Transfer of $SRS

Launch pools for anyWBTC/cWBTC and/or anyETH/cETH

Q4

Multichain and DAO

Multichain/crosschain investigation

Native bridge on polkadot parachain research

Smoothly move governance from committee to DAO

Crypto pools creation with non-pegged pairs

Q4. Every project has a story behind their name, Can you tell us more about the story behind this? Who are the team behind this project? can tell us their background?

Sirius means:

The brightest fixed star

One of the nearest fixed stars to us

25 times brighter than the sun

The hottest summer in ancient Greek(‘Seirios’).

…

So we hope Sirius Finance will also bring Astar Network to summer, or at least help with it.

Sirius is a team of 15 consisting of developers, project managers, marketers and experts in blockchain and smart contracts. Our development team is made up of blockchain engineers with years of experience in Defi projects that are based on solidity coded smart contracts and they are sophisticated with various Defi protocols like AMM, LP farming, IDO launchpad, etc.

Q5. NFT is one of the hottest and most sought-after topics in the blockchain space right now. Can you share your opinion on NFT with us? Do you think NFT will disrupt the current financial system? What is Your project’s approach to the NFT sector?

There are lots of NFT projects so far and they are quite different between each other.

In my opinion, It’s an effective format to form and spread the culture of a community because of its visualisation feature. There is not that much tech in NFTs, while the Defi users are more geeky. It was based on the features of 2 systems.

NFT and Defi are supposed to be complementary, different approaches but the same goal.

We are also considering launching an NFT project, to further expand and strengthen our community base as well as have more people join Web3.

And here we will put best questions from our members and Sirius Finance fans:

Q1: I want to know if you have some plans to spread the awareness about Sirius_Finance in different countries like where English is not used? Do you have local community like India, Vietnam, Indonesia, Thailand, Korea etc so they can also better understand Sirius_Finance?

We launched a 1 million SRS rewards OG program at the beginning of our project, it’s a 3-month assessment program with diversified dimensions.

It’s still going on and works very well so far. It aims to locate users who are really devoted to Sirius Finance by whatever means they are good at, and turn them into our early and long-term supporters.

An important part is to have more insights from users coming from different regions. By supporting them, we will have localized materials, voices being delivered in time, making different strategies when it’s necessary, etc. Shortly, OGs are the message deliverers between us and different markets and we try to bring them as much value as they bring us. Almost everyone can get some as long as you participate and contribute!

As the slogan of our OG enrolment says: by the community, for the community; comes from the community and serves the community.

If you want to know more details about it, please check: https://medium.com/@siriusfinance/by-the-community-for-the-community-from-the-community-and-serves-the-community-a593d7962b80

Besides, we are also making collaborations with communities and projects from different regions to spread awareness.

Q2: I think many people are interested in the $SRS token, both in terms of characteristics and functionality. So can you tell us what are the advantages of holding $SRS long term? What steps would you take to attract more users and educate them?

The basic info of SRS:

Blockchain Network: Astar

Token Supply: 1b

Project Valuation: 10b, It will depend on market conditions and when we reach a relatively high TVL. We are expected to have IDO in late May and also get our native token listed on an exchange around June. So more metrics will be determined then.

Users now can gain SRS rewards by farming on Sirius Finance, we currently have 4Pool for USDC, USDT, BUSD and DAI. The current APR sits attractively at 151.47%.

And there will be another 2 pools added by tmr which enable users to deposit BAI or oUSD (both stablecoins on Astar) to earn double rewards.

By locking up SRS, users can gain veSRS which can be used to vote on:

General governance

Staking rewards

Boost factor up to 3x

Pool weight

Add or remove metapools and tokens

Preferred right for bonus rewards

…

Simply to say, veSRS will become increasingly valuable to decide how future rewards will be distributed.

Compared to traditional token models, veSRS model has some major upsides and some of these are highlighted below:

It encourages long-term-oriented decision-making by incentivizing the same token holders and ensuring long-term commitment to the protocol.

It offers greater incentive alignment across protocol participants. The ve-model has proven to be beneficial since it can align incentives across a wide swath of protocol participants and stakeholders.

It unleashes yield boosting power to tokens holders and also prevent farming and dumping that is commonly seen in most DeFi yield farms.

Lastly, it improves supply and demand dynamics by helping numbers go up and creating sustainable stability.

Q3: So many projects just like to speak about the “long term vision and mission” but what are your short terms objectives? What are you focusing right now?I am interested to invest in Your project. Where & When can I buy Your Tokens? Is it already listed exchanges?

We plan to do IDO by the end of May and get it listed in June which is near the corner.

The whole dev team is focused on developing the product at full speed, including mobile version, governance, veSRS mechanism etc. The good news is we are almost done. And now we have been busy with collaborating with other protocols, bringing more values to our users, fundraising, marketing and community construction.

The short term objective is to have a good performance for IDO and try to maintain it. LOL.

Q4: The main reason why most projects fail is because they do not have incentives in place for liquidity providers. How will SIRIUS FINANCE prevent that from happening on it platform Hope you’ve come up with various incentives to help incentivize liquidity providers on your platform?

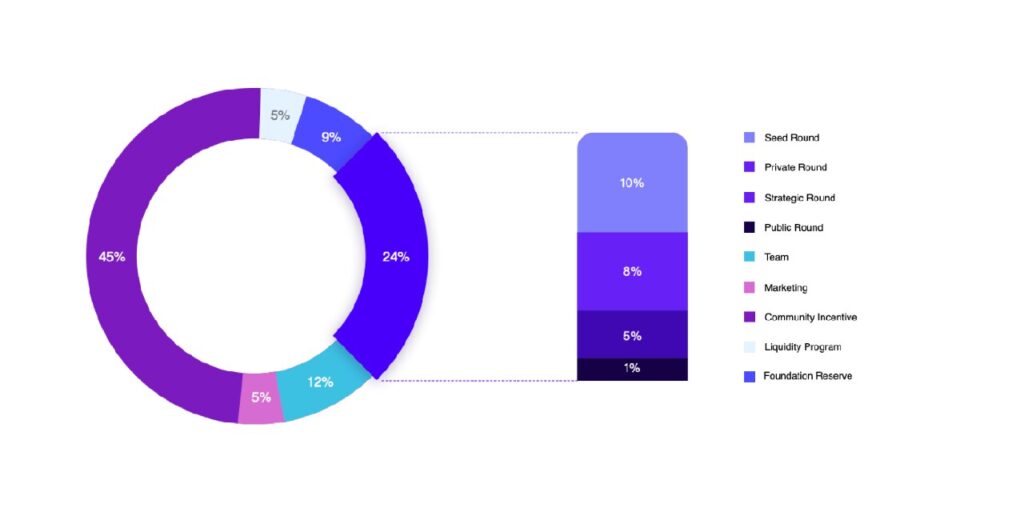

45%(43%+2%) of total SRS supply will be LP incentives to those who provide liquidity on our pools.

From 45%, the 43% is used in this way:The initial annual release amount is 140,000,000 $SRS and the annual release is reduced by a factor of 1.45 per year (360 days to be precise). Approximately 99.54% (428,025,599.4 $SRS) of the total will be released by the end of the 8th year.

Another 2% will also be used in LP incentives but with more flexibilities.

And since we’ve just been admitted to the Astar Network Dapp Staking program, which means there will also be income from staking that we can use to incentive our users.

Q5: I believe security is one of the most important to consider before investing in a Project. So, can you tell us what are the security measures does @Sirius_Finance have done so far? Have you done your audit? Would you mind to share it with us?

We are having our codes audited right now by Peckshield. And in the future, we’ll also have them audited by Certik and Slowmist. We also have our own QA engineers that have been constantly testing out our product. Beyond that, our main protocol is written out of Curve protocol, so the fundamental security has already been proved with a highest TVL in Defi projects.

Besides, we would like to host the bug hunting program to further strengthen our security. Insurance protocol is also one of the plans regarding users funds security.

Q6: Partnership is always an important factor for every project. So who your partner? What are the benefits you get from those relationships?

We now have collaborated with Orcus Finance, Alnair, Libra, AstridDAO, Avault, etc.

We have secured investments from Next Web Capital, DFG, AU 21 Capital, CryptoTimes, GTS Ventures, and pending confirmation with Longhash, Rok and a few other capitals, also have confirmed support from Acala in future liquidity provision. They’ll probably also invest their ecosystem fund in us as they are currently vetting applications.

We gain kinds of support from product enhancements to marketing collaboration. We’ve got more opportunities to communicate with people who share the same goal.

Q7: What is the Best way to follow All your Upcoming news and updates? What are your plans in coming Future?

Twitter will be the first channel for news and discord is recommended to be deeply involved in our community.

Q8: Can you share to us your tokenomics? How much is the total and circulation supply of your tokens? Will there be buy back system or token burning in the future?

https://medium.com/@siriusfinance/sirius-finance-tokenmetrics-overview-19e83d68e041

Almost everything you need to know about our tokenmetrics as well as the utility of SRS and veSRS. And it will also be updated when more info comes out.

Q9: Is your Project A COMMUNITY only for English speaking an few countries or for users not of other languages?

We now have 12 channels for different countries in Discord and 5 tg groups. So no, not a English speaking country, we aim to be global.

Q10: Did you consider community feedback/requests during the creation of your product in order to expand on fresh ideas for your project? Many projects fail because the target audience and clients are not understood. So I’d like to know who your ideal consumer is for your product?

Join our OG program with 1 million SRS rewards in total. And if dive into our discord, you know the message doesn’t have problems of delivering.

We really care our users and all ears to all suggestions as long as it makes sirius better.

And this was the end of our AMA with Sirius Finance.

If you have any questions you can ask here:

Telegram Group: https://t.me/siriusfinanceofficial

ℹ️ℹ️ Useful Links ℹ️ℹ️

- Website: https://www.sirius.finance

- Twitter: https://twitter.com/Sirius_Finance

- Discord: https://discord.gg/7yHgwnWF7F

- Medium: https://medium.com/@siriusfinance

- GitHub: https://github.com/SiriusFinance